Uncertainty Criterions

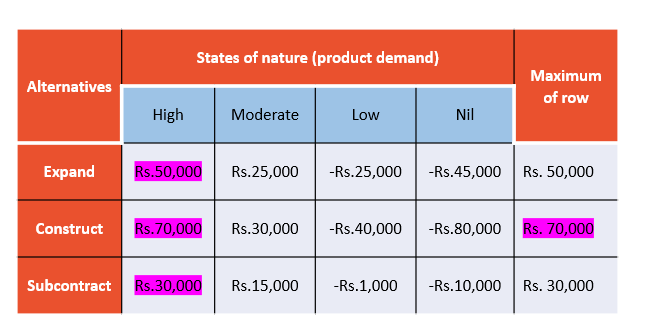

1. Maximax Criterion (Optimistic criterion)

This criterion suggests the decision maker to select the alternative which corresponds to the maximum of maximum payoffs of alternatives. That is, this criterion suggests the decision maker to be optimistic and hence known as optimistic criterion.

The Maximax payoff (maximum of maximum payoffs of alternatives) is Rs. 70,000 which suggests the decision maker to choose Construct.

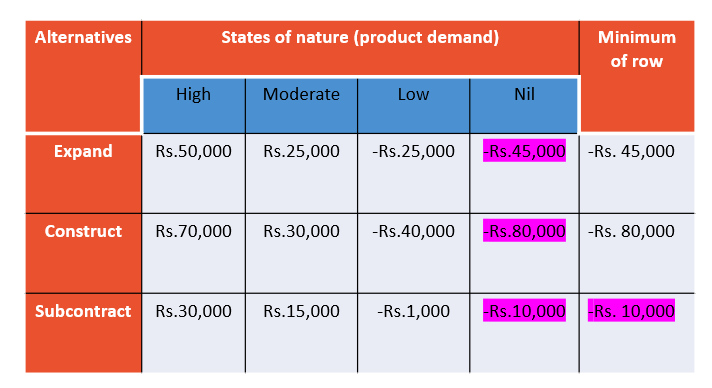

2. Maximin Criterion (Pessimistic criterion)

This criterion suggests the decision maker to select the alternative which corresponds to the maximum of minimum payoffs of alternatives. That is, this criterion suggests the decision maker to be pessimistic and hence known as pessimistic criterion.

The maximin payoff (maximum of minimum payoffs of alternatives) is -Rs. 10,000 which suggests the decision maker to choose Subconstract.

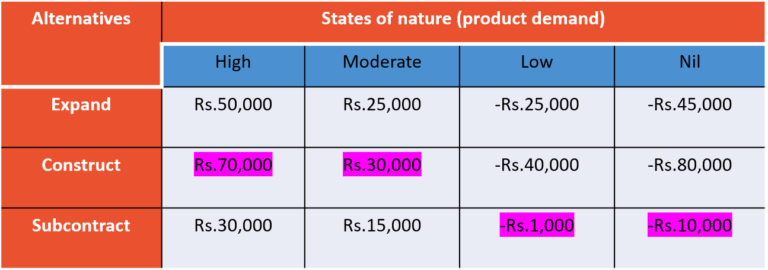

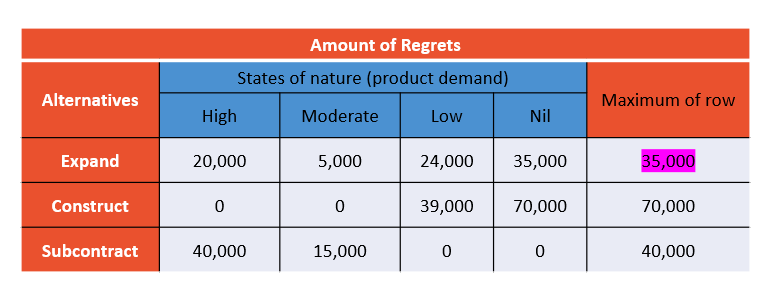

3. Minimax Regret Criterion

This criterion was first introduced by L.J. Savage. He pointed out that the decision maker might experience regret after the decision has been made and events (the states of nature) have occurred. Thus, the decision maker should attempt to minimize regret before actually selecting a particular alternative. The steps involved are:

- Determine the amount of regret for each combination of alternatives and states of nature. The regret for jth event corresponding to ith alternative is given by:

ith regret = maximum payoff for the jth event -ith payoff

2. Determine the maximum regret amount for each alternative

3. Choose the alternative which corresponds to the minimum of the above maximum regrets

This table shows that the company will minimize its regret to Rs.35,000 by selecting alternative Expand.

The minimax regret criterion concentrates on the cost of opportunity lost because of a wrong decision, which the other criterions does not.

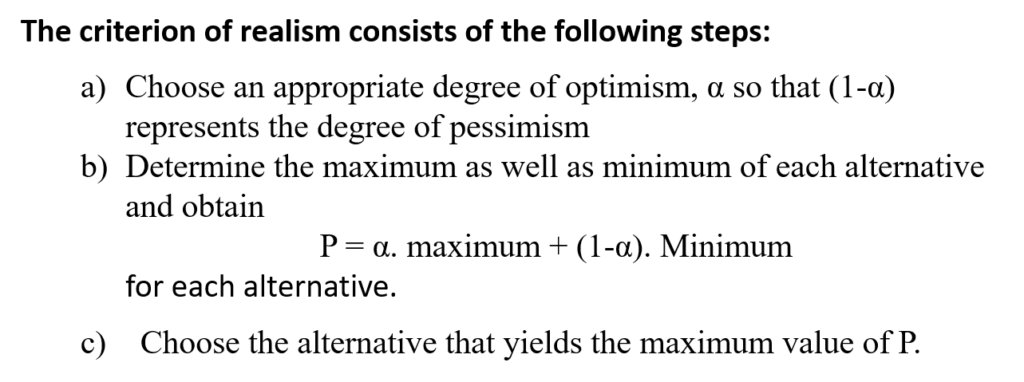

4. Hurwicz Criterion (Criterion of Realism)

Hurwicz criterion or weighted average criterion, is a middle way criterion between Maximax (optimistic) and Maximin (pessimistic) decision criterions. This criterion is based on Hurwicz’s concept of coefficient of optimism (or pessimism).

This criterion takes into account both maximum and minimum payoffs of alternatives and assign them weights according to his degree of optimism (or pessimism). The decision maker will then chooses the alternative which corresponds to the maximum of the sum of weighted payoffs.

The criterion of realism consists of the following steps:

Maximum value of P = Rs.40,000 which suggests the decision maker to choose the alternative Construct.

If α=0, the criterion is too pessimistic; If α=1, it is too optimistic. A value of α between 0 and 1 may be selected depending upon whether the decision maker leans towards pessimism or optimism.

A value of α=1/2 is a reasonable choice in the absence of strong feeling one way or the other.

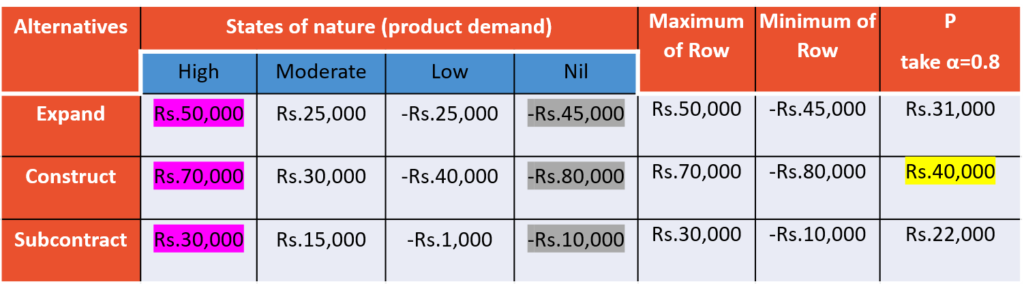

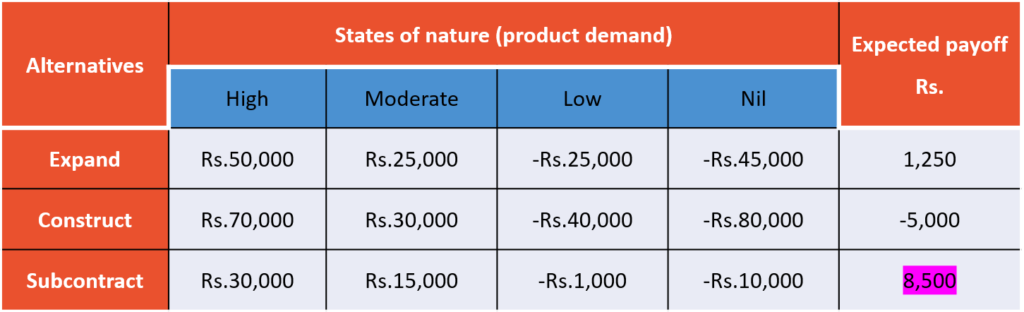

5. Laplace Criterion (Criterion of Rationality)

This criterion is based upon what is known as the principle of insufficient reason. Since the probabilities associated with the occurrence of various events are not known, there is not enough information to conclude that these probabilities will be different. Therefore, this criterion suggests the decision maker to choose the alternative which corresponds to maximum expected payoff.

Symbolically, if n denotes the number of events and P’s denote the payoffs, then expected value for an alternative will be

The maximum average payoff 8,500 corresponds to the alternative Subcontract is the choice given to the decision maker by Laplace criterion.