Decision Making Under Risk

Most business decisions may have been taken under conditions of risk. Here there are more than one states of nature and the decision maker has sufficient information about their probabilities.

These probabilities may be obtained from past records or from simply the decision maker’s individual judgement about future.

Under conditions of risk, a number of decision criterions are available which could be of useful to the decision maker. Let’s see few of them in detail:

- Expected value criterion or Expected Monetary value (EMV) criterion

- Expected Opportunity Loss (EOL) Criterion

Let’s see them in detail.

1. Expected Value Criterion:

This criterion is also known as Expected Monetary value (EMV) criterion. This criterion requires the calculation of the expected value of weighted payoffs for each alternative, where the weights are nothing but the probabilities assigned to the states of nature.

The criterion consists of the following steps:

- Constructing the payoff table with alternatives and states of nature along with associated probabilities.

- Constructing the table of weighted payoffs by multiplying each payoff with the corresponding probability. Then find EMV for each alternative, where EMV is the sum of weighted payoffs (i.e., sum of multiplications of probability and payoff)

- Select the alternative which corresponds to maximum EMV.

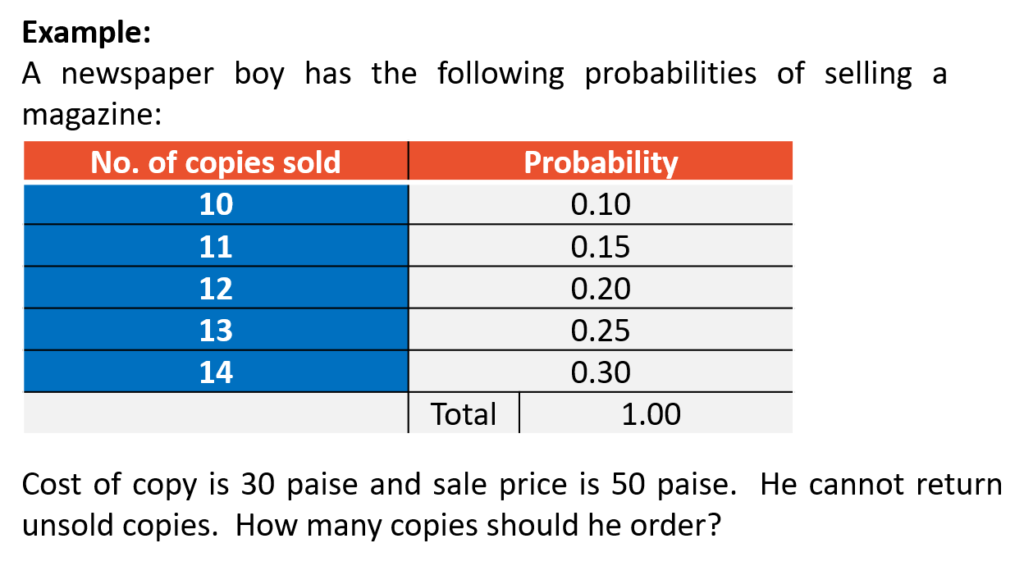

Step 1: Constructing Payoff Table

Payoff = Profit * No. of copies sold – cost of copy * No. of unsold copies

i.e., Payoff = 20 * No. of copies sold – 30 * No. of unsold copies

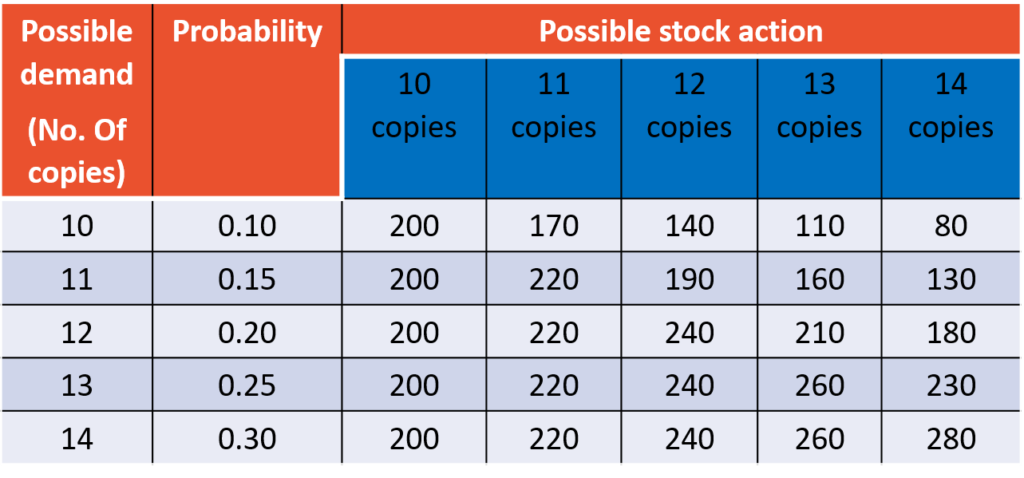

Step 2: Calculating EMV for each alternative

EMV for an alternative = Sum of (Payoff * Probability) for that alternative

Step 3: The highest EMV is 222.5 which suggests that the newspaper boy must order 12 copies to earn the highest possible average profit of 222.5 paise.

This decision of stocking 12 copies daily will maximize the total profits over a period of time. Although, it is not sure that he will make a profit of 222.5 paise tomorrow but if he stocks 12 copies on all days, he will have an average profit of 222.5 paise per day. This is the best he can do because the choice of any one of the other four possible stock actions will result in a lower daily profit.

2. Expected Opportunity Loss Criterion:

An alternative approach to maximizing EMV approach is simply minimizing Expected Opportunity Loss (EOL). Expected opportunity loss or Expected Value of Regrets is the amount of profit that might be skidded because of a decision made by the decision maker. This criterion suggests the decision maker to choose the alternative which corresponds to the minimum value of EOL.

The steps in calculating expected opportunity losses are:

- Constructing the payoff table with alternatives and states of nature along with associated probabilities.

- Constructing the table of COL’s where COL (conditional opportunity loss) is obtained by subtracting each payoff from the maximum payoff possible for an event.

- Constructing the table of weighted COL’s by multiplying each COL with the corresponding probability. Then find EOL for each alternative, where EOL is the sum of weighted COLs (i.e., sum of multiplications of probability and COL values)

- Select the alternative which corresponds to the minimum EOL.

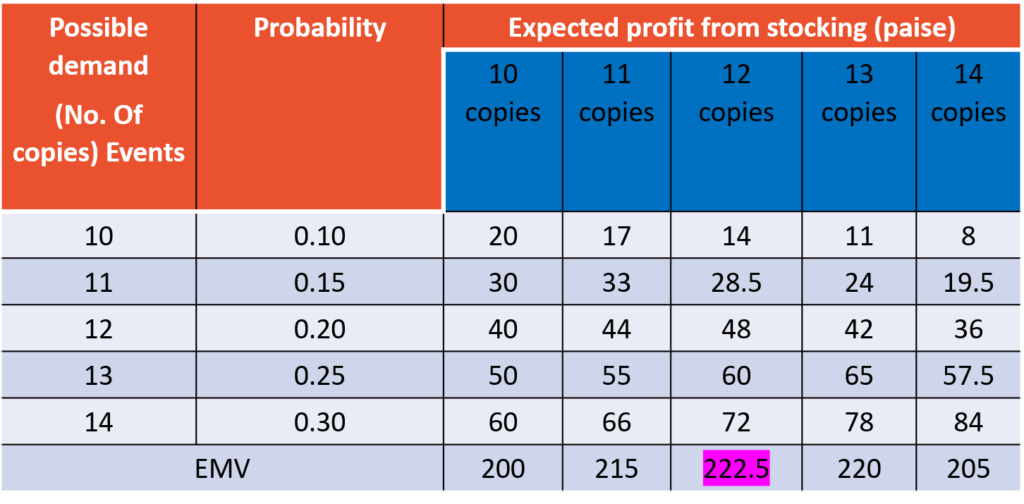

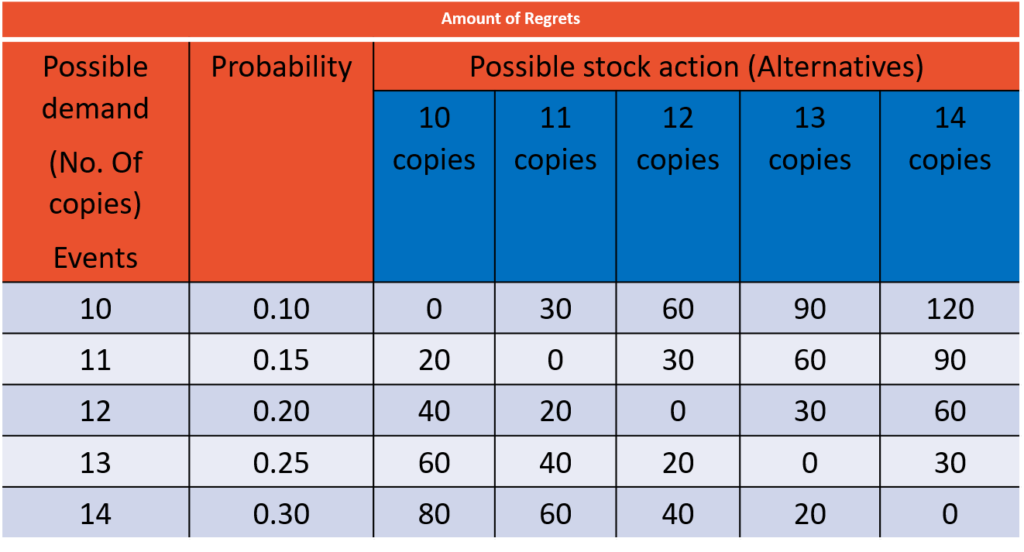

Calculating COL for each alternative:

Amount of regret (COL) = Maximum payoff of that event(row) – payoff

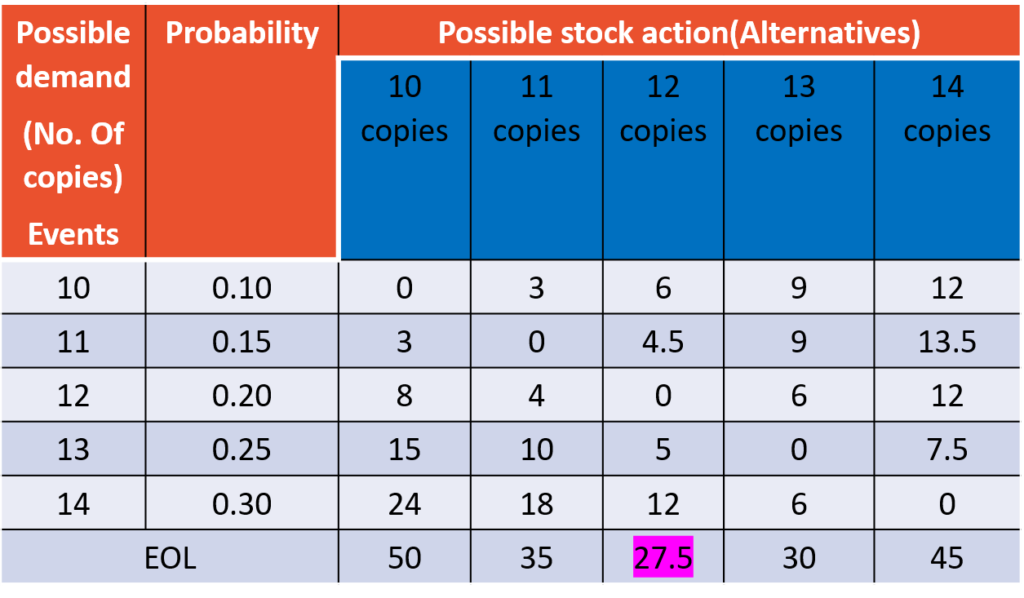

Calculating the EOL for each alternative:

Weighted COL = COL * Probability and

EOL = Sum of weighted COL

The lowest EOL is 27.5 which is the optimum stock action. Thus, the EOL criterion suggests that the newspaper boy must order 12 copies to minimize his expected loss to 27.5 paise.

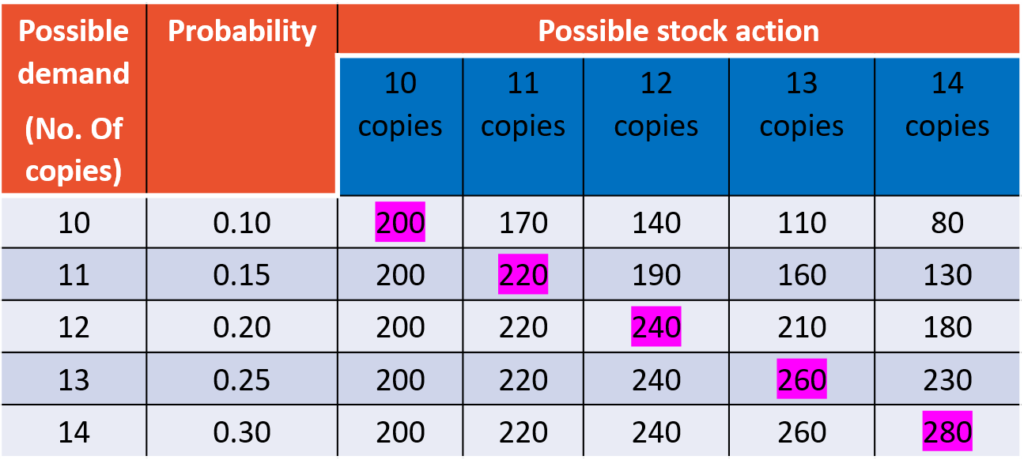

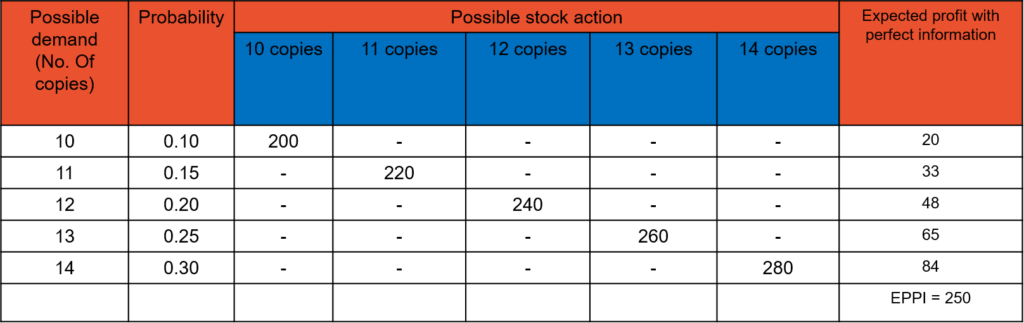

Expected Value of Perfect Information (EVPI)

In decision making under conditions of risk, the probability of occurrence for each state of nature (event) is known. Perfect information (i.e., absolute precise information about the occurrence of an event) will remove all uncertainty in decision making.

With the help of perfect information, the decision maker could choose most profitable alternative. If possible, a decision maker may get perfect information by spending some amount but not more than his profit.

This concept is known as Expected value of perfect information (EVPI). EVPI represents the maximum amount a person could spend to get additional information.

Let us understand with the help of our example. First let us calculate the amount of profit the news paper boy may get with perfect information about the demand. If he knows that the demand for tomorrow will be 14 copies then he simply stock 14 copies not more not less. So, he may get 280 paise as profit. If the demand is just 10 copies then he need not stock 12 copies as suggested by EMV or EOL criterions.

Expected profit with perfect information (EPPI) = 250 paise

The best expected daily profit (EMV) without information is 222.5 (stocking 12 copies all the days)

So, The maximum amount the paper boy could spend for perfect predictor = 250-222.5 = 27.5 (EOL)